Consolidate legacy applications with an end-to-end platform

Reduce costs while enhancing every facet of the asset finance lifecycle.

Operational cost reduction

Data-driven collaboration

Smoother upgrades

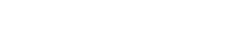

API-first approach

Addition by subtraction

Working off multiple systems creates data silos and disruptions that stifle growth. Our API-first, end-to-end platform takes incompatibility out of the equation.

Functions connect in real-time, replacing manual tasks and limited visibility with automation and data-driven decision-making.

Teams can work smarter — and faster — using robust insights and collaboration tools. With flexibility to add or configure solutions on your own schedule, you’ll always be poised to scale.

Five ways consolidation drives lending revenue

Zero redundant applications

Mergers, acquisitions, and even organic growth may leave organizations with overlapping tools. It can be confusing — and costly. Bring together originations, servicing, analytics, and other functions to maximize cost-efficiency.

One shared source of truth

Avoid the growing pains that make it difficult to scale. With an end-to-end asset finance platform, new locations will launch with the same depth of data and capabilities as your flagship teams.

Smooth upgrades and troubleshooting

Our developers constantly improve the platform to keep pace with market and regulatory requirements. When you need assistance, dedicated support teams are on standby.

Resilient security

Compliance and data privacy standards continue to rise. Fewer applications allow you to apply consistent policies, make updates, and produce reports with less effort.

Dynamic client experiences

Dedicated support and fast time-to-funding are crucial to customer loyalty. Our platform includes self-service portals that provide your customers and partners with 24/7 assistance, reducing your workload while building relationships that last.

Join the industry leaders maximizing opportunities with Odessa

Optimize resources

Avoid solutions with overlapping functionality. Eliminate disruptions caused by incompatible tools.

Make data-driven decisions

Receive actionable insights across all your functions: originations, servicing, remarketing, and more.

Automate workflows

Replace time-consuming, error-prone manual tasks so you can focus on earning revenue.

Improve collaboration

Equip teams across every function to share data and innovate workflows, together.

Reduce risk

Protect private data and meet compliance requirements more easily with only one platform to manage.

Gain a partner

Work directly with one vendor dedicated to solving challenges and driving growth.

Discover the benefits of an end-to-end platform

BLOG

Digital Payments: Building the Future of Asset Finance with APIs

BLOG

The Difference Between as Asset-Based and Contract-Based Leasing Platform

BLOG

3 Steps to Improve Digital Customer Experience

x

Simplify your asset finance tech stack

Consolidating platforms creates new opportunities for cost reduction. Let’s discuss how we can help.